May 2025 witnessed a remarkable market turnaround as equities rallied strongly, with the S&P 500 erasing its earlier year-to-date declines. This recovery unfolded amid evolving trade negotiations, varied economic indicators, and persistent questions about America’s fiscal position. Despite positive economic fundamentals, consumer confidence remained subdued. Bond yields experienced volatility throughout the period as investors weighed federal spending concerns and debt obligations. For those with long-term investment horizons, May demonstrated markets’ capacity to navigate uncertainty, even when policy and economic outlooks remain unclear.

Primary Market and Economic Factor

- The S&P 500 advanced 6.2% during May, marking its strongest monthly performance since 2023, while the Dow Jones Industrial Average climbed 3.9% and the Nasdaq surged 9.6%. For the year through May, the S&P 500 stands at +0.5%, the Dow at -0.6%, and the Nasdaq at -1.0%.

- The Bloomberg U.S. Aggregate Bond index fell 0.7% in May but maintains a 2.4% year-to-date gain. The 10-year Treasury yield concluded May at 4.4%.

- Global equities also posted solid gains, with both the MSCI EAFE developed markets index and MSCI EM emerging markets index rising 4.0%.

- The U.S. dollar index continued its decline, finishing May at 99.3, approaching three-year lows.

- Bitcoin reached a fresh all-time high of $111,092 before settling at $104,834 by month-end.

- Gold similarly achieved a new peak at $3,422 before closing May at $3,288, representing a 24% year-to-date increase.

- May’s Consumer Price Index data revealed consumer prices increased 2.3% year-over-year in April, the smallest 12-month gain since February 2021.

- Employment data showed 177,000 jobs were created in April, with unemployment holding steady at 4.2%.

Equity markets demonstrated resilience amid fresh uncertainties

The May rally highlights the value of maintaining investment discipline during volatile periods. Following April’s setbacks, markets showed their adaptive capacity by recouping most losses and returning to positive ground in May. This swift sentiment reversal exemplifies how rapidly conditions can improve when stability emerges, a dynamic long-term investors have witnessed repeatedly in recent years. However, past performance doesn’t guarantee future results, and markets will likely continue monitoring trade developments, debt concerns, and economic health in upcoming months.

Credit agency reduces U.S. sovereign rating

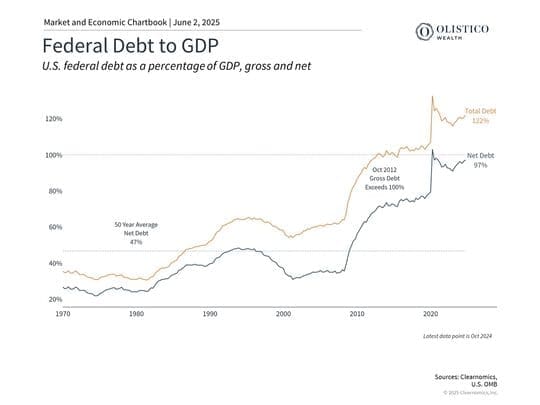

Among May’s most significant developments was Moody’s decision to lower the U.S. credit rating from Aaa to Aa1. This action follows earlier downgrades by Fitch in 2023 and Standard & Poor’s in 2011, all citing concerns regarding the nation’s expanding debt burden and expenditures. The related chart illustrates how U.S. total debt reached 122% of GDP in 2024. Net debt, excluding intragovernmental holdings, has climbed to 97%.

Despite the unprecedented nature of this credit downgrade, market reaction was notably subdued. This muted response stems from the downgrade’s retrospective nature, as investors are already well-aware of America’s fiscal challenges. The calm reception also draws from lessons learned during the 2011 Standard & Poor’s downgrade, when Treasury securities maintained their status as preferred safe-haven investments.

The timing may not have been coincidental, as the House of Representatives was simultaneously advancing comprehensive tax and spending legislation. The passed bill would maintain individual tax reductions from the Tax Cuts and Jobs Act. This encompasses a 37% maximum rate, child tax credits, expanded State and Local Tax deduction limits, and tip and overtime exemptions, among other provisions. The Penn Wharton Budget Model estimates this legislation could expand deficits by $2.8 trillion across the next decade. The Senate will now consider and potentially amend the bill.

Though many acknowledge these fiscal challenges necessitate long-term remedies, the U.S. dollar retains its position as the global primary reserve currency, ensuring continued Treasury demand for the foreseeable period.

Commercial negotiations advance positively

May also brought meaningful advancement in trade discussions, eliminating several worst-case possibilities. The administration secured pacts with both the U.K. and China, while continuing talks with other significant trading partners. The U.S.-China accord established a 90-day window of decreased U.S. tariffs on Chinese products.

Nevertheless, trade uncertainty will probably persist. Recently, both China and the U.S. have claimed the other party violated the trade ceasefire, and the administration seeks elevated steel and aluminum tariffs. Simultaneously, European Union negotiations generated hope when the White House postponed its planned 50% EU tariff following constructive dialogue. This indicates diplomatic resolutions remain viable, even when initial stances seem incompatible.

The administration also confronts legal obstacles to its tariffs. In May, the U.S. Court of International Trade invalidated numerous recently implemented tariffs, determining they surpass presidential authority under the International Economic Emergency Powers Act. Although a federal appeals court suspended this ruling, permitting tariffs to continue temporarily, this legal challenge introduces additional trade landscape uncertainty.

Trade policy typically evolves over months and years rather than days or weeks. May’s recovery reminds investors not to overreact to trade news, particularly since extreme scenarios now appear less probable.

Consistent earnings expansion bolsters equities

First quarter corporate results provided additional grounds for optimism. S&P 500 firms exceeded earnings per share expectations, with 64% reporting positive revenue surprises, per FactSet data. This robust earnings showing emphasized the fundamental strength of corporate profitability, particularly as technology firms demonstrated resilience while managing trade uncertainties.

Conversely, consumers have maintained pessimistic outlooks this year due to tariff and inflation worries. Yet recent sentiment measures began indicating improvements that better align with positive earnings and economic statistics. The University of Michigan’s latest May survey revealed slightly declining inflation expectations and stabilizing sentiment. While one month’s data shouldn’t be overinterpreted, this progress represents an encouraging sign. A robust economy combined with improving sentiment could provide market support.

The bottom line? May proved rewarding for investors. Although the U.S. credit downgrade and fiscal challenges presented new obstacles, trade agreement progress helped elevate markets. For long-term investors, these events emphasize the importance of maintaining perspective and concentrating on fundamental trends rather than short-term policy developments.

Sources

1. Standard & Poor’s, Nasdaq, Bloomberg. All month-end figures are as of May 30, 2025.

2. https://budgetmodel.wharton.upenn.edu/issues/2025/5/23/house-reconciliation-bill-budget-economic-and-distributional-effects-may-22-2025

3. FactSet Earnings Insight May 30, 2025